How to Value a Bank (inbunden, eng)

1 149 kr

1 149 kr

Ons, 9 jul - tor, 10 jul

Säker betalning

14-dagars öppet köp

Säljs och levereras av

Buyersclub.seProduktbeskrivning

The author sheds light on financial institutions’ reporting and financial statements and explains how to interpret the data. Special attention is given to the different valuation approaches for financial institutions ranging from the basic PE and PBV methodologies to the more sophisticated ones such Discount cash flow (DCF), Dividend discount model (DDM), excess return models (EVA), and their variant, the warranted equity value (WEV) method.

The authors also illustrate how to build a sum-of-the-parts model (SOTP) and how to treat capital in the process as well as developing a bottom-up approach for the cost of equity. The book provides numerous real-world examples which will hopefully help practitioners build their own MS Excel models.

Furthermore, this publication investigates some of the critical aspects of banking M&A and its valuation implications. This book also takes a deep dive into valuation for Banks in gone concern status, describing the basis for three different types of valuation of Banks in resolution: to inform a decision on whether to put a bank into resolution; to inform the choice of resolution tools and the extent of any bail-in of liabilities; and to determine whether any creditors would have been better off had the bank gone into insolvency.

Special attention is given to the valuation of non-performing loans (NPLs) and financial assets focusing on some operational aspects of winding-down a bank’s loan and trading book portfolio.

Format Inbunden Omfång 115 sidor Språk Engelska Förlag Springer International Publishing AG Utgivningsdatum 2023-11-30 ISBN 9783031438714

Artikel.nr.

0cc72f01-7f18-5571-bcb4-2685410e47a5

Egenskaper | |

|---|---|

Modell | Pappersbok |

Språkversion | Engelska |

Bokomslagstyp | Inbunden |

Antal sidor | 115 sidor |

Skrivet av | Alessandro Santoni, Federico Salerno |

Illustratör | 11 b/w illustrations, 4 illustrations in colour |

Utgivare | Springer Cham |

Släpp datum | 30/11/2023 |

Typ av utgåva | Första upplagan |

International Standard Book Number (ISBN) | 9783031438714 |

How to Value a Bank (inbunden, eng)

1 149 kr

1 149 kr

Ons, 9 jul - tor, 10 jul

Säker betalning

14-dagars öppet köp

Säljs och levereras av

Buyersclub.seLiknande toppsäljare

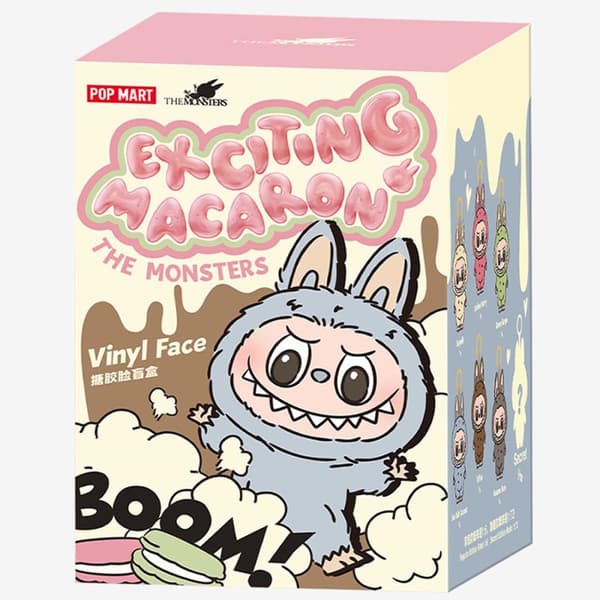

POP MART Labubu The Monsters Exciting Macaron Vinyl Face Blind Box

499 kr

Apple AirPods 4 med aktiv brusreducering

2 070 kr

3-pack ersättningsblad för Philips OneBlade för män

209 kr

Tidigare lägsta pris:

259 kr

Mi Smart Standing Fan 2 (EU)

849 kr

Tidigare lägsta pris:

1 090 kr

INF TYPE-C Dubbel SD/TF-kortläsare för snabb dataöverföring 0

79 kr

Malibu Fast Tanning Bronzing Butter with Beta Carotene 300ml

139 kr

Apple AirPods 4 Wireless In-ear

1 578 kr

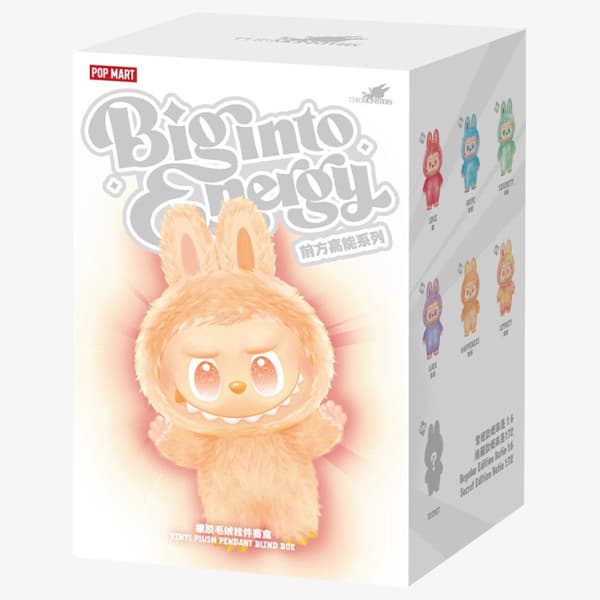

POP MART Labubu The Monsters Big Into Energy Series Figures Vinyl Plush Pendant Blind Box

499 kr

T4 PRO - Hopfällbar elskoter - 8,5 tum - 350W motor - 36V 10,4Ah batteri - Max autonomi 30 km - Bluetooth - Svart

2 379 kr

Tidigare lägsta pris:

2 969 kr

Trådlös CarPlay adapter 2025 - En smart och modern lösning för din bil

219 kr

Tidigare lägsta pris:

295 kr

Rekommendationer för dig

SUV-bil luftmadrass uppblåsbar madrass avtagbar bil säng grå

599 kr

Tidigare lägsta pris:

649 kr

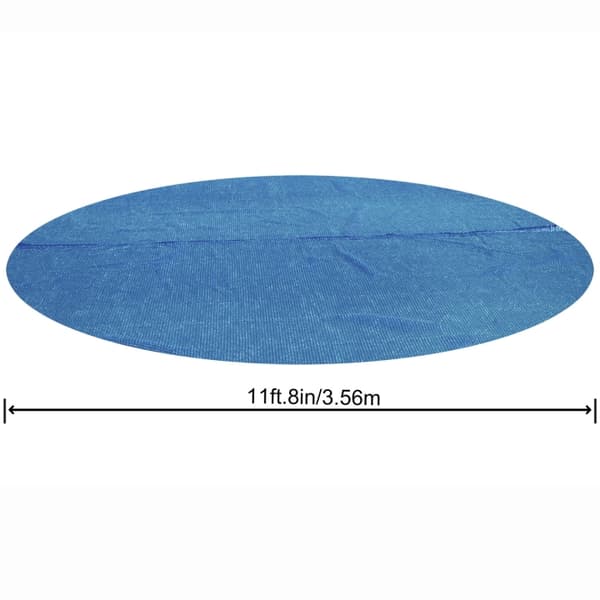

Bestway Flowclear Solar Pool Cover 3,56m

349 kr

2-Pack - Xiaomi Däck med Verktyg - Punkteringsfritt / Elscooter

249 kr

Tidigare lägsta pris:

269 kr

Apple AirTag (4-pack)

1 190 kr

168-Pack Tuschpennor med Fodral - Färgpennor Dubbelsidiga Pennor

299 kr

Tidigare lägsta pris:

399 kr

Samsung Galaxy Buds3 Pro - Silver

1 593 kr

iPhone Snabbladdare USB-C PD 3.0. 20W Strömadapter + Kabel

117 kr

INF Öronkuddar för Bose QC35 I/II, QC25, QC15, QC 2 AE 2, AE 2i, AE 2w, SoundTrue, SoundLink

79 kr

Tidigare lägsta pris:

99 kr

UNIQ XL Hollywood Spegel med 15 LED-lampor och touch-funktion - sminkspegel med belysning - hollywoodspegel

749 kr

Tidigare lägsta pris:

795 kr

X500 Trådlösa Bluetooth Hörlurar - 30 timmar C4U® ANC ENC BT 5.3

269 kr

Tidigare lägsta pris:

399 kr