International Taxation of Trust Income

1 563 kr

1 563 kr

Ons, 23 jul - tis, 29 jul

Säker betalning

14-dagars öppet köp

Säljs och levereras av

AdlibrisProduktbeskrivning

Artikel.nr.

063b2679-472f-5ced-b91a-b7327548a62d

International Taxation of Trust Income

1 563 kr

1 563 kr

Ons, 23 jul - tis, 29 jul

Säker betalning

14-dagars öppet köp

Säljs och levereras av

AdlibrisLiknande toppsäljare

Mi Smart Standing Fan 2 (EU)

849 kr

Tidigare lägsta pris:

1 090 kr

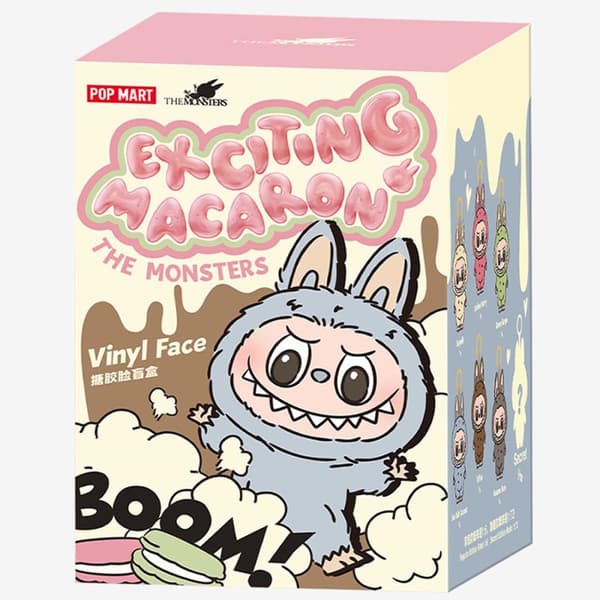

POP MART Labubu The Monsters Exciting Macaron Vinyl Face Blind Box

499 kr

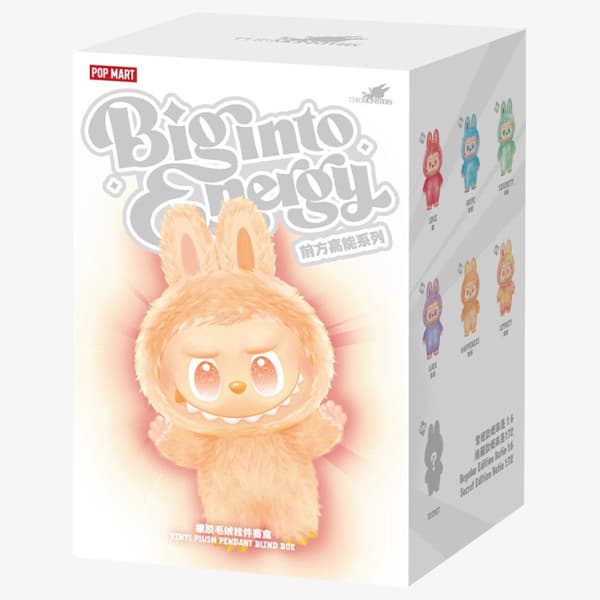

POP MART Labubu The Monsters Big Into Energy Series Figures Vinyl Plush Pendant Blind Box

499 kr

3-pack ersättningsblad för Philips OneBlade för män

209 kr

Tidigare lägsta pris:

259 kr

T4 PRO - Hopfällbar elskoter - 8,5 tum - 350W motor - 36V 10,4Ah batteri - Max autonomi 30 km - Bluetooth - Svart

2 379 kr

Tidigare lägsta pris:

2 969 kr

INF TYPE-C Dubbel SD/TF-kortläsare för snabb dataöverföring 0

79 kr

Sony PlayStation DualSense - White (PS5)

699 kr

Kodak Pixpro FZ45 digital kamera, svart Svart

1 489 kr

PÅFYLLNINGSSATS FÖR BILLUFTKONDITIONERING GAS KÖLDMEDEL R134A + 3-I-1

514 kr

Apple AirPods 4 med aktiv brusreducering

2 060 kr

Rekommendationer för dig

iPhone Snabbladdare USB-C PD 3.0. 20W Strömadapter + Kabel

117 kr

Fotoalbum 300 bilder limbundet

119 kr

Tidigare lägsta pris:

129 kr

Malibu Fast Tanning Bronzing Butter with Beta Carotene 300ml

139 kr

128GB SanDisk Extreme Pro SDXC Class 10 UHS-I U3 V30 A2 200/90MB/s

279 kr

168-Pack Tuschpennor med Fodral - Färgpennor Dubbelsidiga Pennor

299 kr

Tidigare lägsta pris:

399 kr

INF Öronkuddar för Bose QC35 I/II, QC25, QC15, QC 2 AE 2, AE 2i, AE 2w, SoundTrue, SoundLink

79 kr

Tidigare lägsta pris:

99 kr

Trådlös CarPlay adapter 2025 - En smart och modern lösning för din bil

219 kr

Tidigare lägsta pris:

295 kr

2-Pack - Xiaomi Däck med Verktyg - Punkteringsfritt / Elscooter

249 kr

Tidigare lägsta pris:

269 kr

X500 Trådlösa Bluetooth Hörlurar - 30 timmar C4U® ANC ENC BT 5.3

269 kr

Tidigare lägsta pris:

399 kr

Xiaomi Elscooter laddare – Original Scooter1S/Lite/Pro/3

229 kr

Tidigare lägsta pris:

299 kr