-3 %

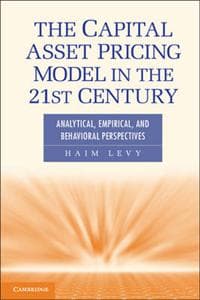

The Capital Asset Pricing Model in the 21st Century

488 kr

488 kr

Tidigare lägsta pris:

505 kr

I lager

Ons, 30 apr - tis, 6 maj

Säker betalning

14-dagars öppet köp

Säljs och levereras av

Adlibris

Produktbeskrivning

The Capital Asset Pricing Model (CAPM) and the mean-variance (M-V) rule, which are based on classic expected utility theory, have been heavily criticized theoretically and empirically. The advent of behavioral economics, prospect theory and other psychology-minded approaches in finance challenges the rational investor model from which CAPM and M-V derive. Haim Levy argues that the tension between the classic financial models and behavioral economics approaches is more apparent than real. This book aims to relax the tension between the two paradigms. Specifically, Professor Levy shows that although behavioral economics contradicts aspects of expected utility theory, CAPM and M-V are intact in both expected utility theory and cumulative prospect theory frameworks. There is furthermore no evidence to reject CAPM empirically when ex-ante parameters are employed. Professionals may thus comfortably teach and use CAPM and behavioral economics or cumulative prospect theory as coexisting paradigms.

Artikel.nr.

6537bdd5-4365-4f75-bfdc-b3b6efec8abc

The Capital Asset Pricing Model in the 21st Century

488 kr

488 kr

Tidigare lägsta pris:

505 kr

I lager

Ons, 30 apr - tis, 6 maj

Säker betalning

14-dagars öppet köp

Säljs och levereras av

Adlibris

Liknande toppsäljare

-6 %

Apple

Apple AirPods Pro (2nd Generation) USB-C

2 589 kr

Tidigare lägsta pris:

2 750 kr

4,6

torsdag, 24 apr

-10 %

AOVOPRO

Elkickbike för vuxna AOVOPRO M365 Scooter - 350W - 10.5Ah - Svart

2 159 kr

Tidigare lägsta pris:

2 399 kr

tisdag, 6 maj

Nice price-6 %

SAMSUNG

Samsung Galaxy Tab A9+ Wifi 64GB Svart

2 022 kr

Tidigare lägsta pris:

2 150 kr

4,5

onsdag, 23 apr

USB-C

Laddare för iPhone 15 / iPhone 16 + 2M kabel Snabbladdare USB-C till USB-C

99 kr

3,9

tisdag, 29 apr

-6 %

Uniq Vanity

UNIQ XL Hollywood Spegel med 15 LED-lampor och touch-funktion - sminkspegel med belysning - hollywoodspegel

795 kr

Tidigare lägsta pris:

849 kr

4,9

onsdag, 23 apr

Moorle

2-i-1 Elektrisk Rakhyvel för Kvinnor, Vattentät, Bikinitrimmer, Dubbelhuvud, Typ-C Rosa

234 kr

tisdag, 6 maj

-15 %

Vitu

Astronaut Nattlampa / Galaxylampa - Stjärnhimmelsprojektor

279 kr

Tidigare lägsta pris:

329 kr

4,3

torsdag, 24 apr

Nice price-6 %

Sony PlayStation DualSense - White (PS5)

798 kr

Tidigare lägsta pris:

847 kr

4,4

torsdag, 24 apr

-17 %

SEDSHOP

Laddare till Samsung 25W - Snabbladdare USB-C - Strömadapter+Kabel 1M

99 kr

Tidigare lägsta pris:

119 kr

4,2

måndag, 28 apr

3 för 649 kr

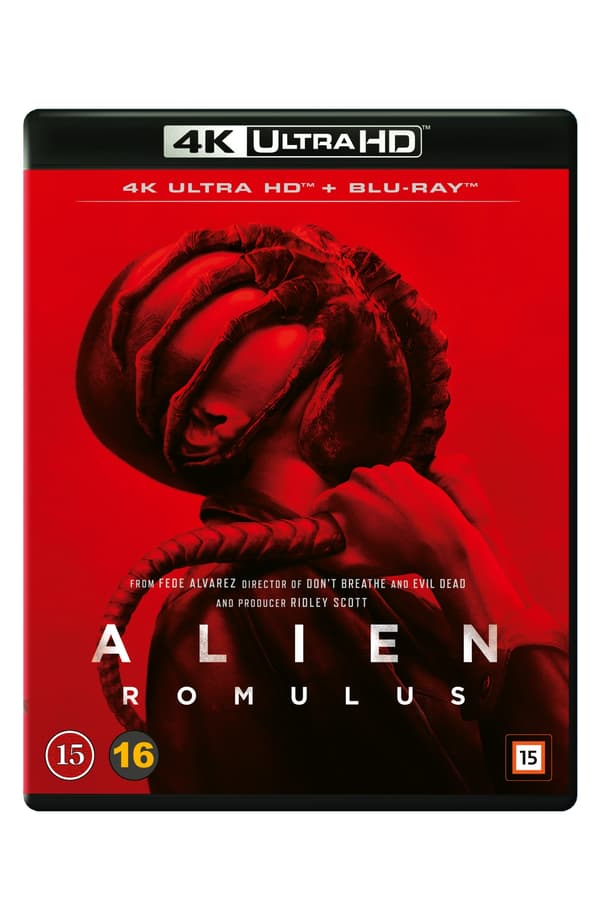

ALIEN: ROMULUS

329 kr

4,3

tisdag, 13 maj

Rekommendationer för dig

WEEN

Öronkuddar för Bose QuietComfort - QC35/QC25/QC15/AE2 Hörlurar SVART

95 kr

4,6

torsdag, 24 apr

LIECTROUX

LIECTROUX elektrisk fönsterputsrobot HCR-10 med 30 ml vattentank

999 kr

4,1

fredag, 25 apr

Iconsign

Lash Lift Kit - Permanent Fransböjning Kit - Iconsign Original

179 kr

3,3

torsdag, 24 apr

trade maxx

Snabbladdare Garmin Klockor - Universal Laddare

51 kr

4,5

måndag, 28 apr

KATRIN

Toalettpapper KATRIN 360 42/fp

404 kr

4,5

onsdag, 23 apr

Gardlov

Gräsmatteluftare - Spikskor för att lufta gräsmattan

199 kr

4,0

torsdag, 24 apr

-11 %

INF

INF TYPE-C Dubbel SD/TF-kortläsare för snabb dataöverföring 0

79 kr

Tidigare lägsta pris:

89 kr

3,3

torsdag, 24 apr

Olympiq

12-pack Oral-B Kompatibla Tandborsthuvuden

89 kr

4,3

fredag, 25 apr

Generic

4-Pack - Volkswagen VW Centrumkåpor / Hjulnav Emblem - Bil 65 mm

119 kr

4,1

torsdag, 24 apr

-7 %

Game Controller

PS4 Handkontroll DoubleShock Trådlös för Play-station 4

249 kr

Tidigare lägsta pris:

269 kr

3,7

tisdag, 29 apr