Taxing Corporate Income in the 21st Century

550 kr

550 kr

Fre, 30 maj - tor, 5 jun

Säker betalning

14-dagars öppet köp

Säljs och levereras av

Adlibris

Produktbeskrivning

Artikel.nr.

785cf6e3-a395-5136-80ca-7c2513f33c53

Taxing Corporate Income in the 21st Century

550 kr

550 kr

Fre, 30 maj - tor, 5 jun

Säker betalning

14-dagars öppet köp

Säljs och levereras av

Adlibris

Liknande toppsäljare

Apple AirPods 4 Wireless In-ear

1 554 kr

Tidigare lägsta pris:

1 569 kr

Apple AirPods Pro (andra generationen) 2023 med MagSafe-fodral (USB-C)

2 549 kr

Kompatibel iPhone snabbladdare USB-C strömadapter 20W + 2m Kabel

99 kr

Tidigare lägsta pris:

119 kr

Malibu Fast Tanning Bronzing Butter with Beta Carotene 300ml

139 kr

Röd Vevradio med Solceller, Ficklampa och 2000mAh Powerbank Nödradio, Överlevnad

149 kr

Tidigare lägsta pris:

436 kr

POP MART Labubu The Monsters Macaron 17 cm

159 kr

iPhone kompatibel Plug & Play hörlurar iPhone X/11/12/13/14

99 kr

Apple AirPods Pro (2nd Gen) 2023 USB-C

2 550 kr

Tidigare lägsta pris:

2 675 kr

Elastiskt träningsband till fotboll - Gul/Svart

114 kr

Laddare till Samsung 25W - Snabbladdare USB-C - Strömadapter+Kabel 1M

99 kr

Tidigare lägsta pris:

119 kr

Rekommendationer för dig

Pool Robot Scooby

4 999 kr

Tidigare lägsta pris:

5 429 kr

Mi Smart Standing Fan 2 (EU)

849 kr

Tidigare lägsta pris:

1 090 kr

Hopfällbar Trädgårdspall med Verktyg / Knäpall - Pall

349 kr

Tidigare lägsta pris:

399 kr

Vattenfontän solcellsdriven 16 cm solcellsfontän vatten fontän utomhus Svart

149 kr

Tidigare lägsta pris:

179 kr

Laddare för iPhone 15 / iPhone 16 + 2M kabel Snabbladdare USB-C till USB-C

99 kr

Ralph Lauren Big Pony Pink for Women EdT 50 ml

279 kr

Tidigare lägsta pris:

399 kr

Sony PlayStation DualSense - White (PS5)

798 kr

Tidigare lägsta pris:

847 kr

INF TYPE-C Dubbel SD/TF-kortläsare för snabb dataöverföring 0

79 kr

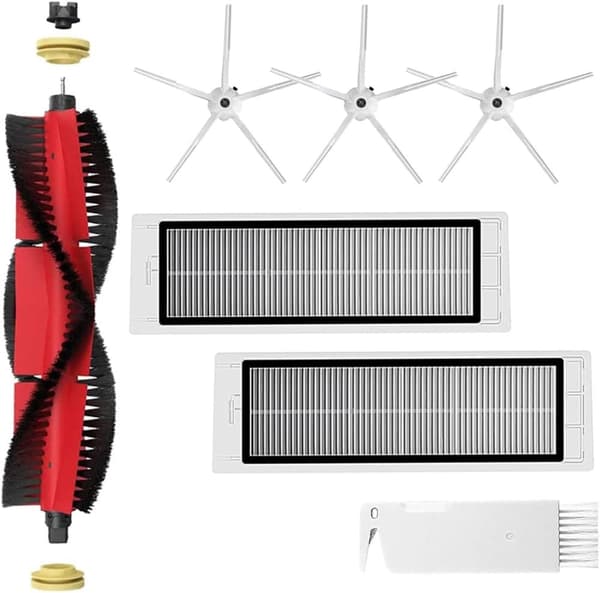

INF Tillbehör för Roborock S5/S6 modeller 7 delar

149 kr

Tidigare lägsta pris:

199 kr

Bright Beauty Vanity Namira - sminkspegel med belysning - hollywoodspegel - make up spegel - vit - dimbar med tre ljuslägen

849 kr

Tidigare lägsta pris:

899 kr